montgomery county al sales tax return

Ad Download Or Email DoR 2100 More Fillable Forms Register and Subscribe Now. What is the sales tax rate in Montgomery Alabama.

County Commission Montgomery County Al

New Business License and Tax Remittance Mailing Address.

. File sales tax faster with Avalara Returns for Small Business. The Montgomery County Sales Tax is 25. Tri County Tax Sales in Montgomery AL.

This is the total of state county and city sales tax rates. A county-wide sales tax rate of 25 is. The sales tax is due monthly with returns and remittances to be filed on or before the 20th day of the month for the previous months sales.

Montgomery county alabama sales tax sellers use tax consumers use tax education only tax mail return with remittance to. Sales Tax and Use Tax Rate of Zip Code 36106 is located in Montgomery City Montgomery County Alabama State. Ad Managed services from Sovos makes your sales tax filings quick easy and painless.

A Montgomery Alabama Sales Tax Permit can only be obtained through an authorized government agency. Depending on local municipalities the total tax rate can be as high as 11. Alabama has a 4 statewide sales tax rate but also has 284 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of.

Sales Tax and Use Tax Rate of Zip Code 36103 is located in Montgomery City Montgomery County Alabama State. The average cumulative sales tax rate in Montgomery Alabama is 10. My Alabama Taxes MAT is the States electronic filing and remittance system used today for the filing of state city and county sales use rental and lodgings taxes.

Our tax preparers will ensure that your tax returns are complete accurate and on time. Alabama has a 4 statewide sales tax rate but also has 284 local tax. As far as other cities towns and locations go the place with the highest sales tax rate is Montgomery and the place with the lowest sales tax rate is Grady.

Montgomery County Alabama Sales Tax Sellers Use Tax Consumers Use Tax Education Only Tax MAIL RETURN WITH REMITTANCE TO. 1 State Sales tax is 400. However pursuant to Section 40-23-7 Code of.

Ad Download Or Email DoR 2100 More Fillable Forms Register and Subscribe Now. Berkheimer Associates - This company handles local taxes of over 1100 Pennsylvania municipalities and school districts. Motor FuelGasolineOther Fuel Tax Form.

For tax rate information please contact the Department at 256-532-3498 or at salestaxmadisoncountyalgov. Since October 1 2013. The minimum combined 2022 sales tax rate for Montgomery Alabama is.

This includes the rates on the state county city and special levels. This is the total of state and county sales tax rates. Ad Managed services from Sovos makes your sales tax filings quick easy and painless.

Name A - Z Sponsored Links. The minimum combined 2022 sales tax rate for Montgomery County Alabama is. If you need access to a database of all Alabama local sales tax rates visit the sales tax data page.

Box 830469 Birmingham AL 35283-0469 ACCOUNT NO. Montgomery County Commission Tax Audit. 1 State Sales tax is 400.

Our tax preparers will ensure that your tax returns are complete accurate and on time. TAX DAY NOW MAY 17th. Learn more State sales tax rates.

If the filing due date falls on a weekend or holiday sales tax is generally due the next business. RETURN DUE Monthly filers should file each calendar month on or before the 20th of the following month even if no tax is due. Montrose al sales tax rate.

Taxpayer Bill of Rights. Start filing your tax return now. The Alabama state sales tax rate is currently.

Effective JUNE 1 2022 please begin remitting sales business tax and business license returns and payments. The Montgomery County Alabama Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Montgomery County Alabama in the USA using average. Alabama sales tax returns are always due the 20th of the month following the reporting period.

Montgomery is located within Montgomery County. The most populous zip code. Many forms are not accessible through this.

SalesSellers UseConsumers Use Tax Form. Upon the proper completion of a Motor Fuels Gas Excise.

Alabama Sales Tax Guide For Businesses

Alabama Sales Tax Bond Jet Insurance Company

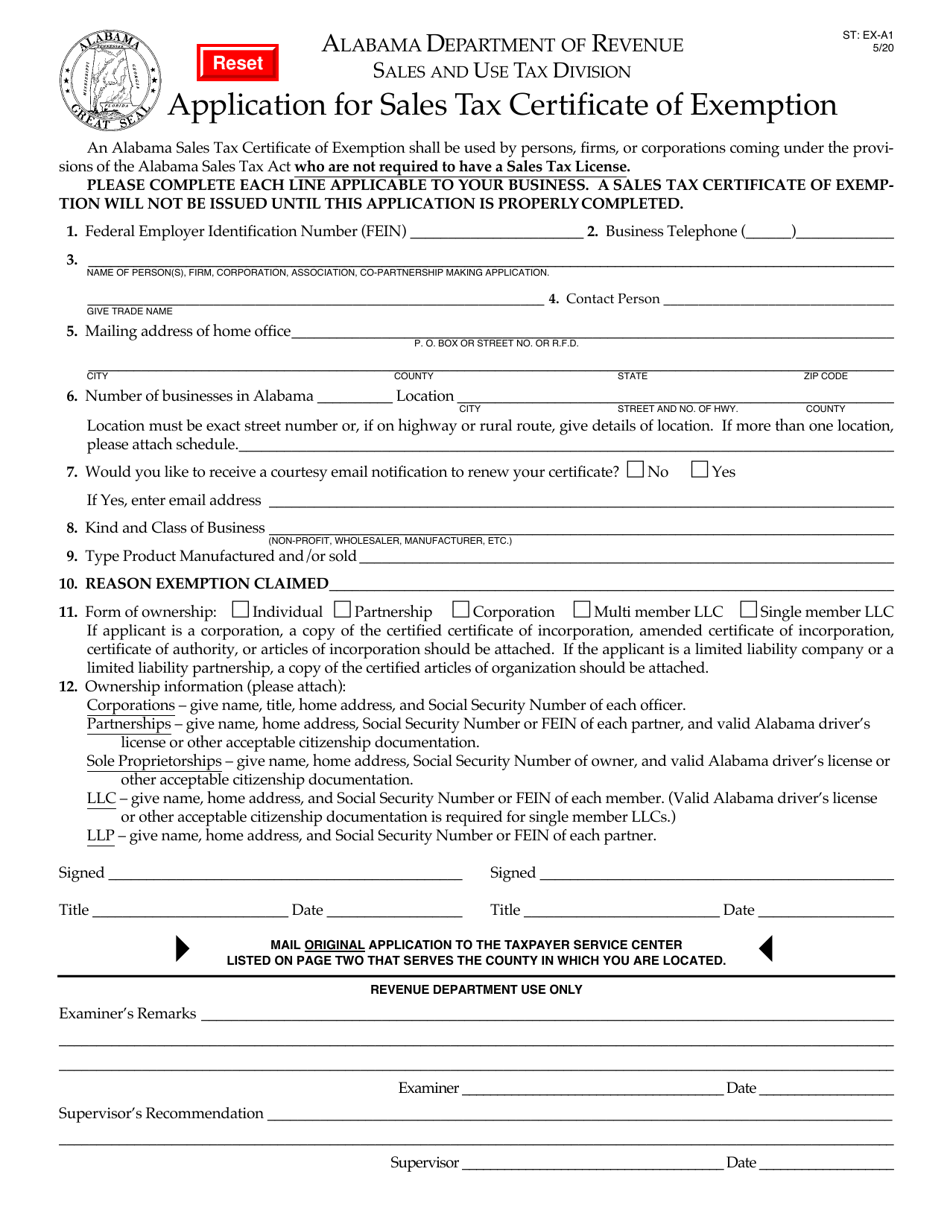

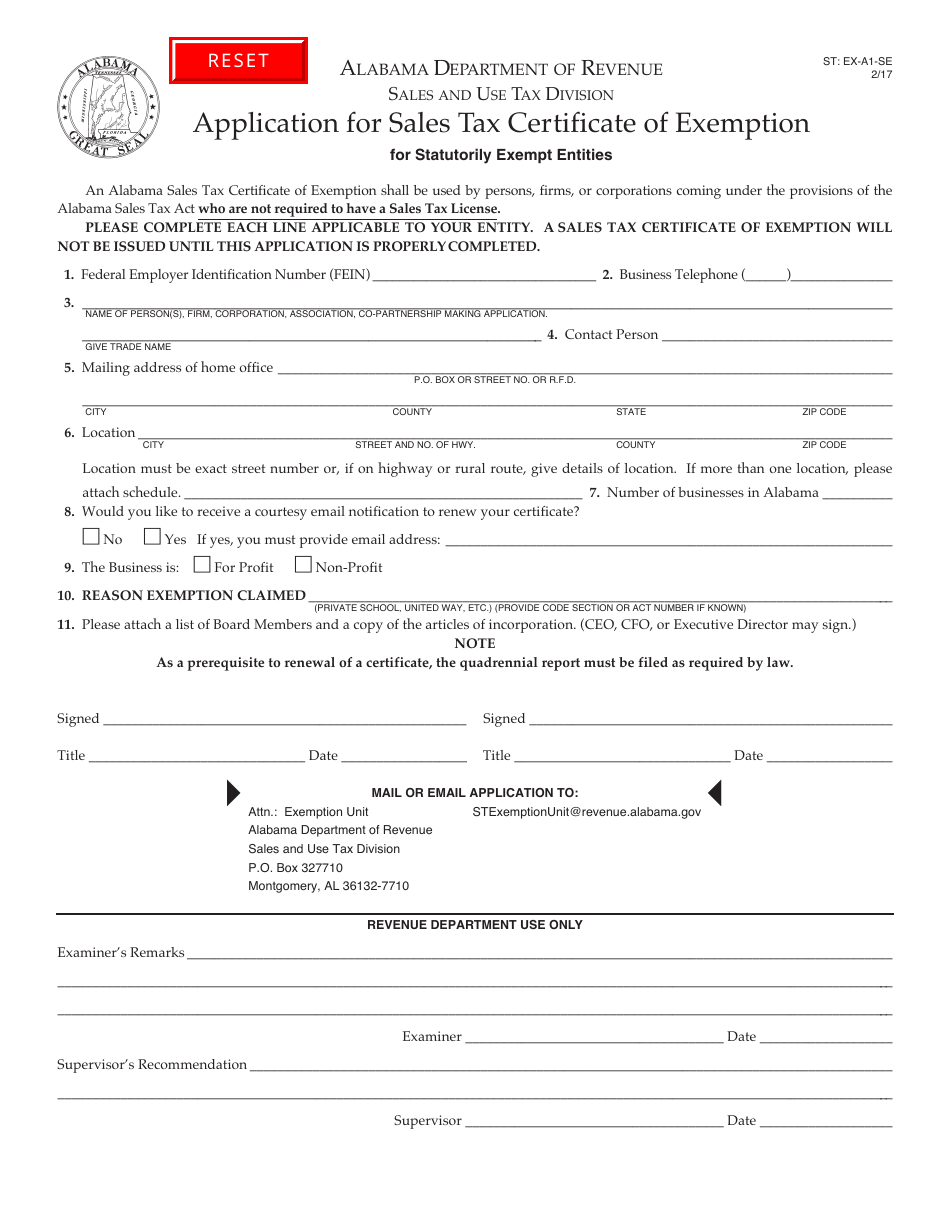

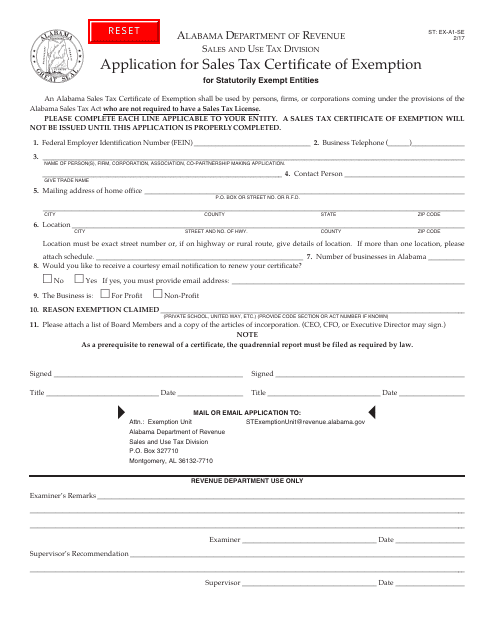

Form St Ex A1 Se Download Fillable Pdf Or Fill Online Application For Sales Tax Certificate Of Exemption For Statutorily Exempt Entities Alabama Templateroller

Appraisal Montgomery County Al

Other Alabama Taxpayer Forms Avenu Insights Analytics Taxpayer

2001 Form Al St Ex A2 Fill Online Printable Fillable Blank Pdffiller

Get And Sign Montgomery County Jurisdictional Addendum To Sales Contract Form

Form St Ex A1 Se Download Fillable Pdf Or Fill Online Application For Sales Tax Certificate Of Exemption For Statutorily Exempt Entities Alabama Templateroller

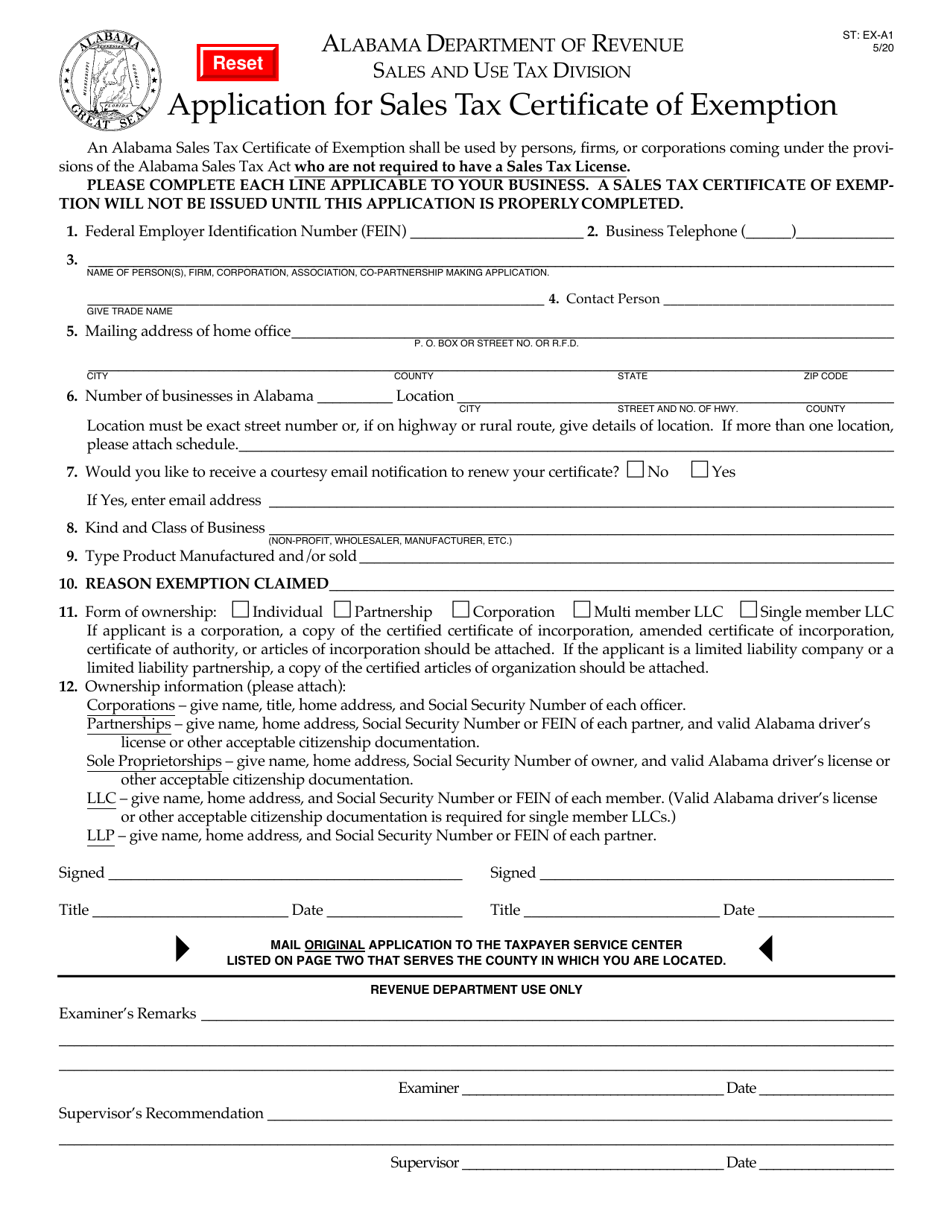

Form St Ex A1 Download Fillable Pdf Or Fill Online Application For Sales Tax Certificate Of Exemption Alabama Templateroller

Maintenance Districts Montgomery County Al

Pennsylvania Sales Tax Guide For Businesses

Alabama Sales Tax Rates By City County 2022

Welcome To Montgomery County Texas

Sales Tax Audit Montgomery County Al